Smart Content Summit: Keynoter Explored the Global M&E Supply Chain

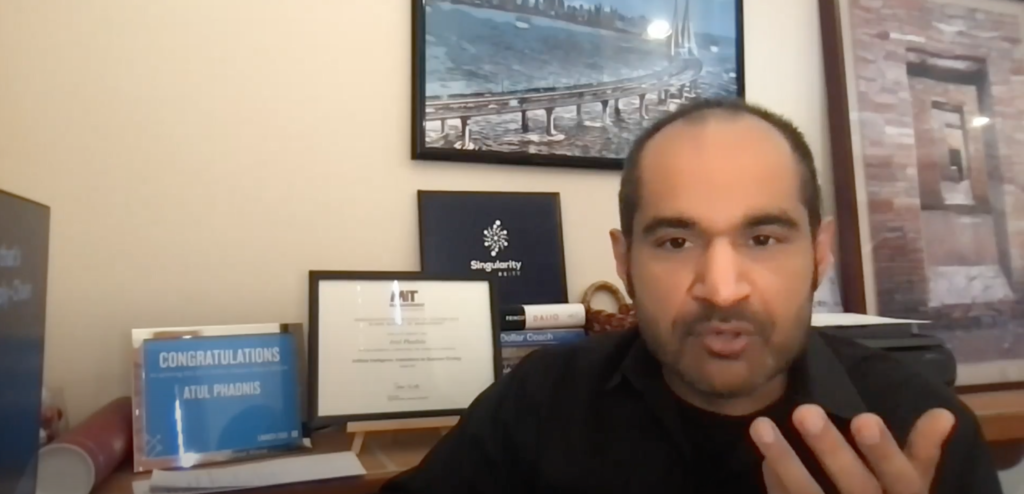

There have been major disruptions in the media and entertainment supply chain, especially in the past 3-5 years, that have significantly impacted M&E companies around the world, according to Atul Phadnis, founder of cross-border content and data intelligence platform Vitrina AI.

“The entire value chain is getting smudged and integrated,” he said 10th March at the Smart Content Summit in Los Angeles, while delivering the opening keynote for the day, “Why Map the Global Supply Chain for the Entertainment Industry?”

Phadnis set the stage for the Smart Content Summit with a deep look at the international M&E “universe” of content creation and distribution, discussing scaling data across the enterprise using artificial intelligence (AI), data and metadata standards, and providing key benefits and use cases around aggregating this kind of information.

“You’ve got a host of companies that were upstream that are rushing to go downstream and launch their own content services,” including distribution companies and studios launching direct-to-consumer offerings, he noted.

“On the other side,” there are device and other companies that were “more downstream that are now going all the way upstream into content production and content funding and content distribution as well,” said Phadnis, who is also the entrepreneur-in-residence for SRI International (formerly the Stanford Research Institute) and previously served as the chief content officer for Gracenote.

Something that has been “happening in the background over the last five years is that the entire business model is getting disrupted from a supply chain perspective and that’s birthing a host of new business models of different versions of video on demand services, fast channels and then a host of other technological aspects coupled on top of the business model disruptions,” he explained.

Looking at it from a non-US perspective, other markets around the world “have been slammed with business model changes and a lot of the globalisation and digitalisation” at the local levels with their local supply chains, he said.

Looking at it from a non-US perspective, other markets around the world “have been slammed with business model changes and a lot of the globalisation and digitalisation” at the local levels with their local supply chains, he said.

So what happens when you have Amazon Prime, Apple TV Plus, Disney Plus, Discovery Plus, Netflix, Paramount Plus, Peacock, PlutoTV and other streaming services all going international at the local levels of many individual domestic markets around the world?

Noting that $255 billion is spent on content annually around the world, he pointed out that Disney and Netflix cumulatively account for $50 billion. Meanwhile, new spending from global major M&E companies in the last three years has totalled hundreds of millions of dollars in individual markets, he noted.

“The $255 billion shock on the global supply chain has been enormous,” he told viewers.

Noting that he regularly speaks to people at companies across the M&E value chain globally, he said, “what we’re hearing from them is that the local domestic collaboration canvas has been completely disrupted.”

As a result, many of the affected companies have been getting “yanked out as global majors have entered” their markets with hundreds of millions of dollars every year in new money that’s entering those domestic businesses,” he said.

This “massive flux” has resulted in many new relationships, while “a lot of the traditional relationships have been disrupted,” he explained.

The pandemic has also been disruptive, causing, for example, different shooting patterns to be used in the past couple of years that have “changed the way we produce, post-produce [and] distribute content,” he told viewers.

“Just in terms of what’s happened in the last three to five years has been astonishing, and the effect of that on the entertainment supply chain has been quite fascinating to watch,” he said.

What Vitrina is Doing

Vitrina is an AI-powered, Software-as-a-Service (SaaS) platform that Phadnis said is “mapping the global entertainment ecosystem and the supply chain.”

The company is, for now, “focused on films, television and streaming,” he noted. But, he said, “we have plans to … go into a few other areas, including gaming” and industrial videos, he pointed out.

For now, mapping and connecting the global supply chain of this $255 billion annual global M&E industry continues to be his company’s main focus, he said.

Survey Findings

Vitrina conducted a study in which it interviewed executives from key stakeholders within the global M&E industry from major Hollywood studios and U.S. media companies, streaming companies including Amazon, Apple and Netflix, international media companies, content services companies including Sohonet and Technicolor, and over-the-top (OTT) device/platform companies including Roku, Phadnis said.

Company departments included in the survey were rights/avails, as well as services and solutions, he noted.

“Some of the results of that study really inspired us to map the supply chain the way that we started doing,” he said.

Among the insights was the existence of “sticker shock” among companies in Africa, Asia and Latin American when dealing with North American companies and the amounts of money they’re spending, he pointed out.

Among the insights was the existence of “sticker shock” among companies in Africa, Asia and Latin American when dealing with North American companies and the amounts of money they’re spending, he pointed out.

Another challenge that the study results underscored was in establishing trust, reputation and credibility when dealing with companies from other countries, he said, adding a key challenge is how to search for the right partners in targeted markets.

“Finding the right cross-border content, partners and vendors came up as the biggest challenge to business expansion through our study,” he told viewers.

Noting that research firms Gartner and KPMG have experienced the same thing in other sectors, he said, “this is a supply chain problem.”

Takeaways So Far

Vitrina is in the process of mapping close to about 900 different services across the content supply chain in the planning, production and distribution areas, Phadnis said.

As of Jan. 31, the company was “close to about 80,000 companies already mapped across the different aspects of the supply chain,” he noted, adding the company is using industry data, AI and its knowledge of the sector.

Vitrina is, meanwhile, “still on the path to map the entire … universe” of 600,000 companies, he added.

The 2022 Smart Content Summit event was held in conjunction with the EIDR Annual Participant Meeting (EIDR APM), and was presented by Whip Media. The event was produced by MESA, in association with the Smart Content Council and EIDR, with sponsorship by BeBanjo, Signiant, Qumulo, Adio, Alteon, Digital Nirvana, Slalom and Rightsline.